Thinking about driving for Lyft? Or already on the road? One important thing to understand is how taxes work for Lyft drivers. Unlike a regular job, you are an independent contractor. That means you handle your own taxes. This guide explains what you need to know about Lyft driver taxes, what you have to pay, what you can deduct, and how to stay organized so you keep more of what you earn.

Why taxes work differently for Lyft drivers

When you drive for Lyft, you are not an employee. You are considered self-employed. That means you do not get taxes taken out of your pay automatically. Instead, you are responsible for paying:

- Federal income tax

- Self-employment tax (for Social Security and Medicare)

- Possible state or local taxes

Many drivers are surprised at tax time when they see how much they owe. Planning ahead can help you avoid that. You might also need to make quarterly estimated tax payments, depending on how much you're projecting to make. These are payments you make four times a year to cover your expected taxes so you do not get hit with a big bill all at once.

Income you need to report

As a driver, you need to report your gross income, which is the total amount you earned before any fees or deductions. Lyft reports your earnings to the IRS and to you using tax forms called 1099s. Lyft may send you:

- 1099-K: Reports payment transactions.

- 1099-NEC: Reports other types of income, like bonuses or incentives.

You can usually download your tax documents from the Lyft driver dashboard or app. Your 1099 will usually show gross earnings, while your Lyft summary may show net (after fees). Make sure you know which number you are using.

Important: Even if you do not get a 1099 form, you must still report all your Lyft income. The IRS requires you to report all income you earned, whether you get a form or not.

Big tax deductions for Lyft drivers

The good news? You can lower the amount of taxes you need to pay by claiming deductions for your business expenses. The IRS understands that running a business comes with many costs, so you only pay tax on your business profit, not your total revenue.

Common Lyft tax deductions include:

- Car expenses: Done by itemizing gas, maintenance, insurance, repairs or by taking the IRS mileage rate

- Tolls and parking fees: When they happen during rides.

- Phone bill: The portion used for Lyft work.

- Supplies: Phone chargers, water bottles for passengers.

- Car washes and detailing: To keep your car clean for riders.

- Rideshare insurance: If you have it.

These deductions help lower your taxable income and save you money.

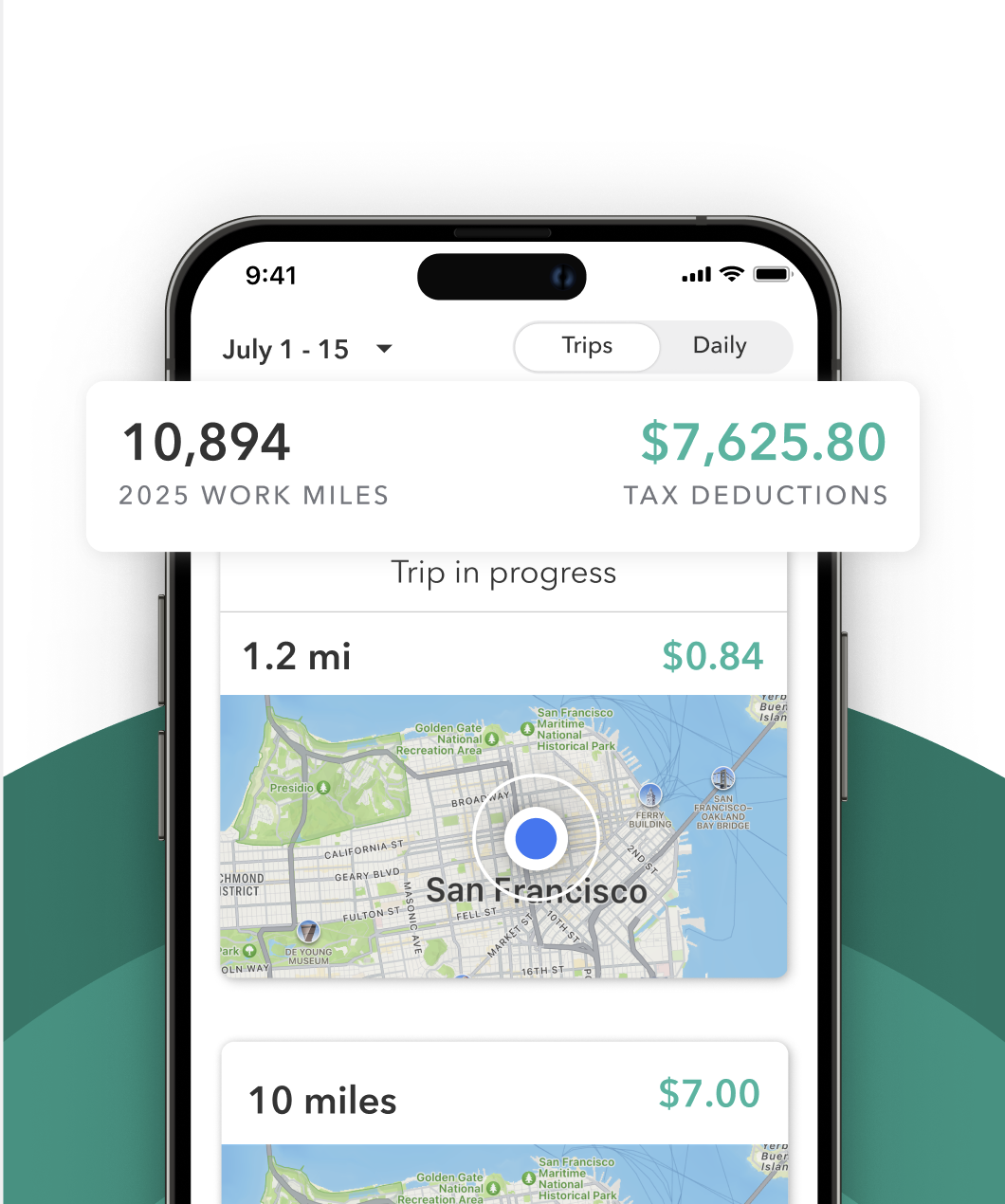

How to track mileage and expenses

The IRS requires drivers to keep detailed records of business expenses. For Lyft mileage tracking, you need:

- Date of each trip

- Starting location and destination

- Business purpose

- Miles driven

You can do this in a notebook, spreadsheet, or with an app like Everlance. Apps can automatically record trips in the background and generate IRS-ready logs, saving you time and reducing errors. Everlance can also help track your expenses, and store your receipts right inside the app, keeping you organized and compliant throughout the year.

How to pay your taxes

As an independent contractor, you file taxes using Schedule C with your Form 1040. You will also complete Schedule SE to calculate self-employment tax. If you expect to owe more than $1,000 in taxes for the year, like mentioned earlier, the IRS expects you to pay quarterly estimated taxes in April, June, September, and January. You can pay online at IRS.gov or through many self-employed tax filing apps & software programs.

Common mistakes to avoid

Here are mistakes that can cost you money or lead to problems with the IRS:

- Not tracking Lyft miles consistently

- Forgetting to save receipts

- Including personal miles as business miles

- Estimating instead of recording trips

- Not making estimated tax payments if required

Avoiding these mistakes helps you keep more of what you earn and stay out of trouble at tax time.

Tips for success

- Track every trip and expense as you go.

- Use a mileage-tracking app to simplify logging.

- Save receipts in one place.

- Set aside part of every payout for taxes.

- Consider talking to a tax professional if you have questions.

Driving for Lyft can be a flexible, rewarding way to earn money. But being your own boss means you are in charge of your own taxes. By understanding what you owe, tracking your mileage and expenses carefully, and taking advantage of available deductions, you can reduce your tax bill and keep more of what you earn