Mileage tracking for the self-employed: maximize your tax savings

Automatically track every mile, organize your business drives, and maximize tax savings with a simple tool designed for self-employed professionals.

What is mileage tracking for the self-employed?

Mileage tracking is the process of recording the miles you drive for business purposes so you can claim them as a deduction on your taxes. For self-employed workers, freelancers, contractors, and gig drivers, every mile matters. The IRS allows you to deduct business mileage at a standard rate each year, which can translate into thousands of dollars saved.

For 2025, the IRS standard mileage rate is 70 cents per mile. That means if you drive 10,000 business miles in a year, you could deduct $7,000 from your taxable income. Mileage tracking is not just a good practice, it’s essential for lowering your tax bill and staying compliant with IRS requirements.

The true cost of missed mileage deductions

Many self-employed individuals underestimate how much they could save simply by keeping accurate mileage records. Forgetting to log trips or relying on guesswork leads to missed deductions, which means you’re overpaying taxes.

Even worse, if you’re audited and can’t produce a mileage log that meets IRS standards, your deductions could be denied. The IRS requires details like the date, miles driven, and business purpose for each trip. Without a proper log, you risk penalties, back taxes, and unnecessary stress.

The average freelancer or small business owner can save $3,000–$7,000 per year in mileage deductions. That’s money you can reinvest into your business, or keep in your pocket.

Step-by-step guide to tracking mileage

Know the IRS standard mileage rate

Each year, the IRS sets a mileage deduction rate. For 2025, it’s 70¢ per mile

Record every business trip

Log the date, starting point, destination, purpose of the trip, and total miles

Keep an IRS-compliant mileage log

Whether digital or paper, your log must contain consistent, accurate records

Use the information to file taxes

At tax time, include your mileage deductions on Schedule C or the appropriate self-employment tax forms

Manual logs vs spreadsheets vs apps

Paper log

Excel or Google sheets

Mileage tracking apps (Everlance)

Pros

Cheap, simple

Easy to organize

Auto-detects trips, IRS-ready reports, saves hours

Cons

Time-consuming, error-prone

Still manual, requires discipline

Free versions have limitations, cost to unlock all features

If you’re still writing trips in a notebook or plugging them into a spreadsheet, you’re leaving money, and time, on the table. Everlance automatically tracks every mile you drive and creates audit-proof reports in seconds.

Automate mileage tracking with everlance

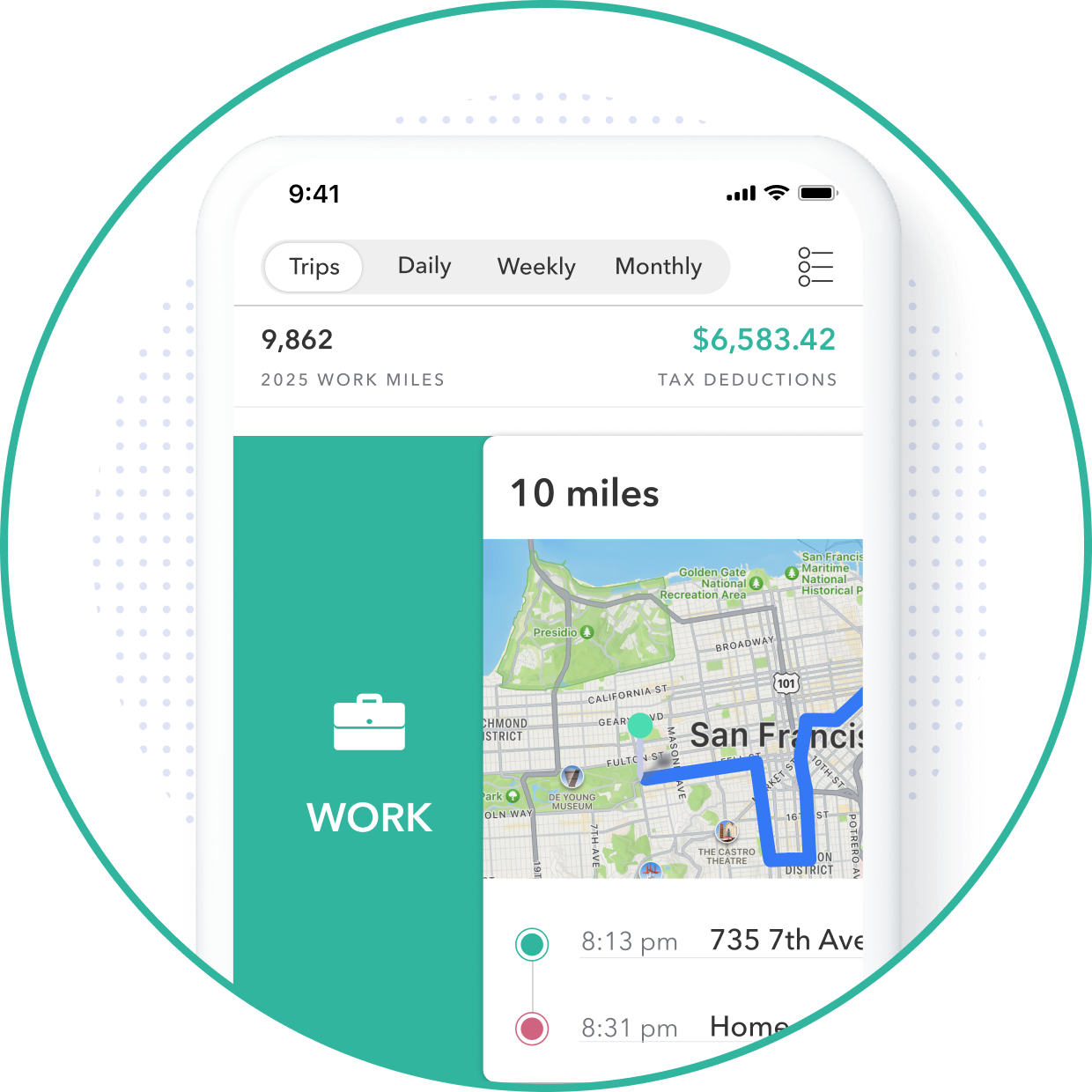

Everlance is the #1 mileage tracking app built for self-employed professionals. Instead of stressing over forgotten trips or complicated spreadsheets, Everlance handles everything for you.Everlance was built for self-employed professionals who don’t want to miss a single deduction.

Here’s how Everlance works:

With Everlance, you’ll never miss a deduction again. Our users save an average of $6,500 per year on taxes just from mileage tracking.

Start tracking free with Everlance today

Download for free“I’m a freelance photographer, and Everlance saved me $4,200 last year in mileage deductions. I don’t know how I managed before this app.”

Sarah R

Free tools to simplify mileage tracking

Everlance goes beyond tracking, we provide resources to make your financial life easier.

Mileage tracking FAQs for self-employed

How much mileage can I deduct in 2025?

You can deduct 70¢ per business mile driven.

What counts as business vs personal miles?

Trips for clients, meetings, deliveries, or gig work count as business. Commutes to a fixed office generally do not.

Do I need receipts for mileage?

No, but you must keep a mileage log with dates, miles, and purposes.

What happens if I don’t keep a mileage log?

The IRS can deny your deduction, leaving you with higher taxes and possible penalties.

“As a rideshare driver, tracking every mile is essential. Everlance pays for itself within weeks.”

Carlos G

Start tracking mileage the easy way

Don’t risk losing thousands in deductions or spending hours on manual logs. Everlance makes mileage tracking effortless, accurate, and IRS-compliant.

Easy swipe classification