Driving for Uber gives you flexibility and control over your schedule, but it also comes with some financial responsibility, especially when it comes to taxes. Unlike traditional employees, Uber drivers are classified as independent contractors. That means you’re in charge of tracking your income, managing expenses, and making sure your taxes get paid on time.

Whether you’re a full-time driver or just picking up rides on weekends, this guide will walk you through exactly what you need to know for tax season: no fluff, no jargon.

Are Uber drivers self-employed?

Yes. If you drive for Uber, you’re considered self-employed in the eyes of the IRS. That means you’re responsible for filing your own taxes and paying both income tax and self-employment tax, the latter covers the Social Security and Medicare contributions an employer would typically handle on your behalf.

It also means you’re eligible for business deductions, which can lower your tax bill significantly, but only if you track them properly.

What taxes do Uber drivers need to pay?

There are two main types:

- Income tax: Just like everyone else, you’ll pay federal (and often state) income taxes based on your net earnings.

- Self-employment tax: This is a 15.3% tax that covers Social Security and Medicare.

Here’s the catch: Uber doesn’t withhold taxes from your pay. That means it’s up to you to save for taxes throughout the year and make quarterly estimated tax payments if you expect to owe $1,000 or more.

Uber Tax Documents

If you earn more than $600 in a calendar year with Uber, you’ll typically receive a 1099-NEC. If you process a high volume of transactions or use Uber’s third-party payment platform, you might also receive a 1099-K.

Uber also provides a Tax Summary in your driver dashboard, which includes your gross earnings and certain expenses like service fees or booking fees. But be careful, this summary doesn’t capture all the deductions you may be eligible to claim.

Do I have to file taxes for Uber if I made less than $600?

Yes, you still have to report your income, even if you earned less than $600 from Uber.

The $600 threshold only applies to when Uber is required to send you a 1099-NEC form. It does not mean you’re off the hook for taxes. The IRS expects you to report all self-employment income, no matter how small. So even if you only drove a few weekends or made a few hundred dollars, it still counts as taxable income. Failing to report it could lead to penalties down the road.

Bottom line: If you earned any income through Uber, you should report it when filing your taxes even without a 1099 form.

Deductions that lower your Uber taxes

This is where self-employment works in your favor: you can deduct business expenses that directly relate to your Uber work. Here are some of the biggest ones:

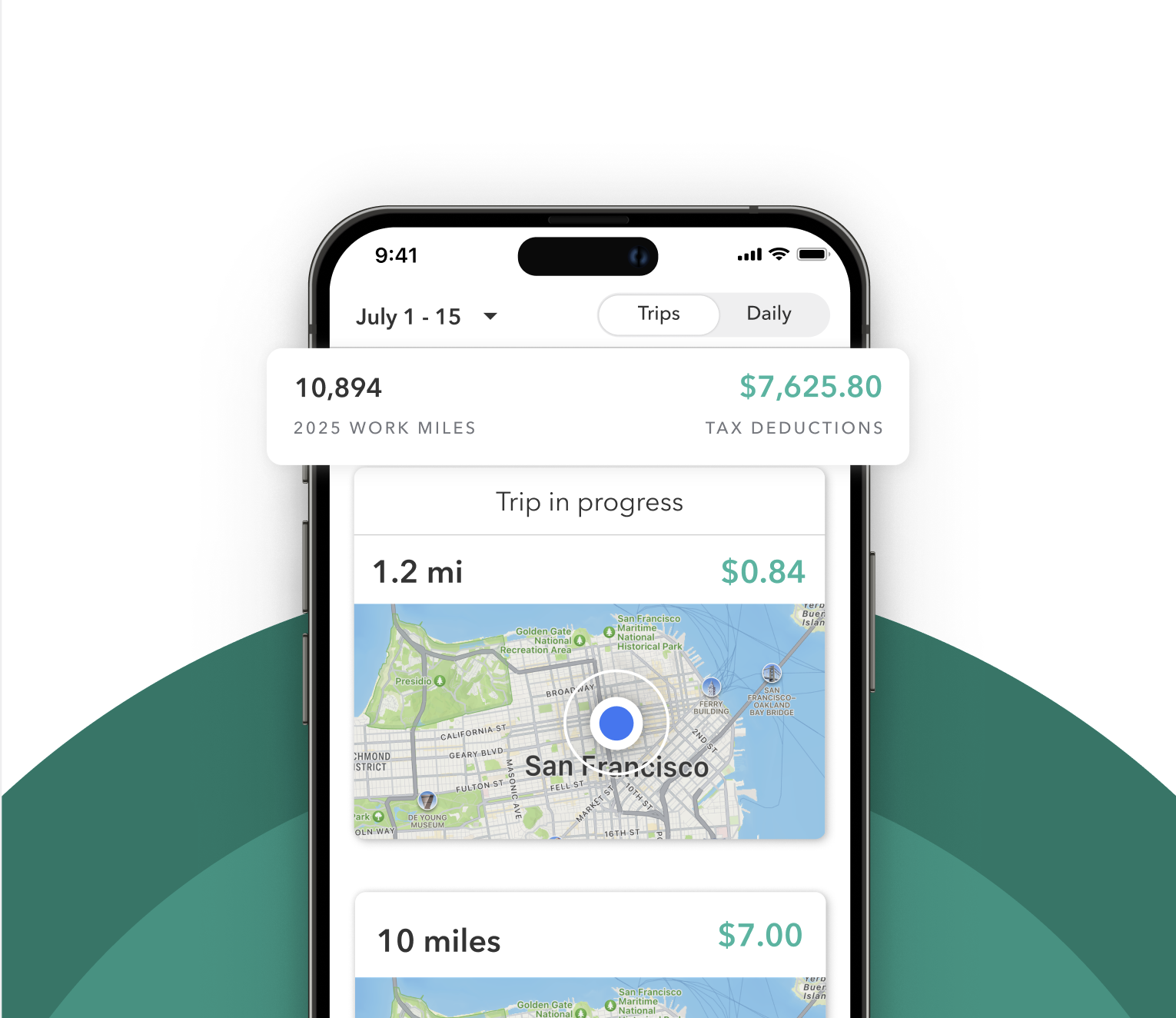

- Mileage: The most common deduction for drivers. To deduct your mileage, you just simply take the current IRS mileage rate and multiply it by the amount of business miles you drove.

- Phone and data plan: You rely on your phone for Uber navigation, communication, and earnings tracking. You can deduct the portion used for business.

- Tolls and parking: These count if you pay them during rides.

- Supplies: Car chargers, phone mounts, water bottles for riders, it all adds up.

- Vehicle maintenance and depreciation: If you choose the actual expenses method, you’ll need to track these in detail.

You can use the standard mileage method or the actual expense method, but not both. Most drivers choose standard mileage because it’s simpler, especially when you use an mileage tracking app for Uber like Everlance to log your trips automatically.