Taxes for the self-employed: A complete guide

Learn how self-employment taxes work and get simple guidance to stay compliant, maximize savings, and avoid costly filing mistakes.

What are self-employment taxes?

Self-employment taxes are the taxes freelancers, contractors, gig workers, and small business owners pay on their income. Unlike traditional employees, who have Social Security and Medicare automatically withheld from their paychecks, self-employed individuals are responsible for paying both the employer and employee portions.

For 2025, the self-employment tax rate is 15.3%:

- 12.4% for Social Security

- 2.9% for Medicare

If you earn more than $200,000 (single) or $250,000 (married filing jointly), you may also owe an additional 0.9% Medicare surtax. Understanding how self-employment taxes work is critical to avoid surprises and keep more of what you earn.

Why self-employment taxes matter

Many first-time freelancers underestimate how much they owe in taxes. Because there are no automatic paycheck withholdings, it’s easy to underpay or fall behind. The IRS requires self-employed workers who expect to owe more than $1,000 in taxes to pay quarterly estimated taxes.

Failing to pay on time can lead to penalties and interest. On the flip side, smart tax planning helps you:

- Avoid IRS penalties

- Spread your payments across the year

- Maximize deductions to reduce taxable income

- Keep better cash flow control

In short, understanding and managing your self-employment taxes is essential for staying compliant and protecting your bottom line.

Step-by-step guide to paying self-employment taxes

Calculate your net earnings

Subtract business expenses (mileage, supplies, home office, etc.) from your gross income

Determine your taxable income

Apply the 15.3% self-employment tax rate to your net earnings

Make quarterly estimated payments

Use IRS Form 1040-ES to calculate and pay estimated taxes four times a year. Deadlines typically fall in April, June, September, and January

File at tax time

Report your income and expenses on Schedule C, and pay any remaining balance when filing your Form 1040

Methods of managing self-employment taxes

Manual calculations

Tax software

Tax apps

Pros

No extra tools needed

Streamlined, built-in calculators

Auto-track expenses, maximize deductions, IRS-ready reports

Cons

Easy to make errors, time-consuming

May miss industry-specific deductions

Requires setup

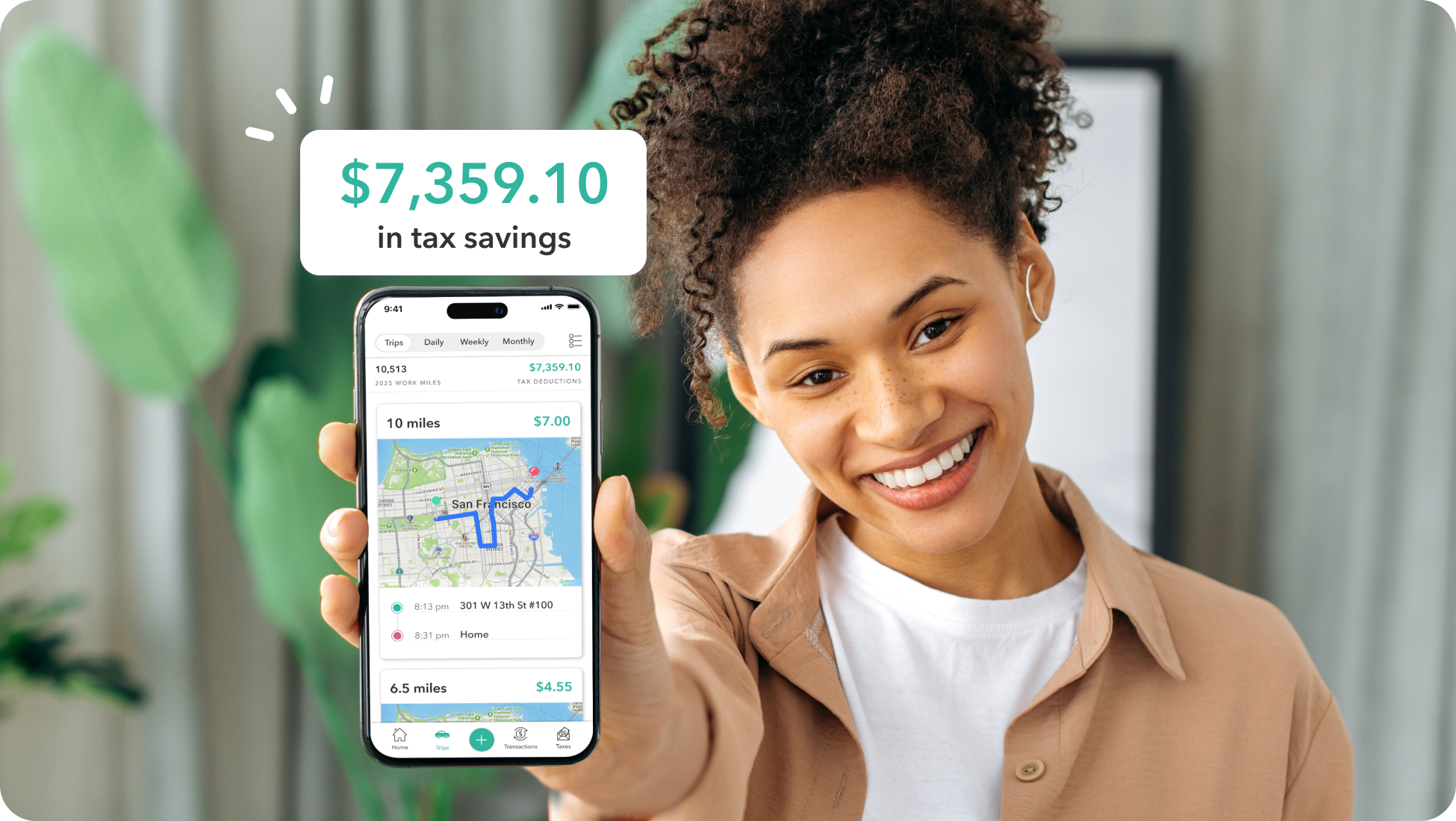

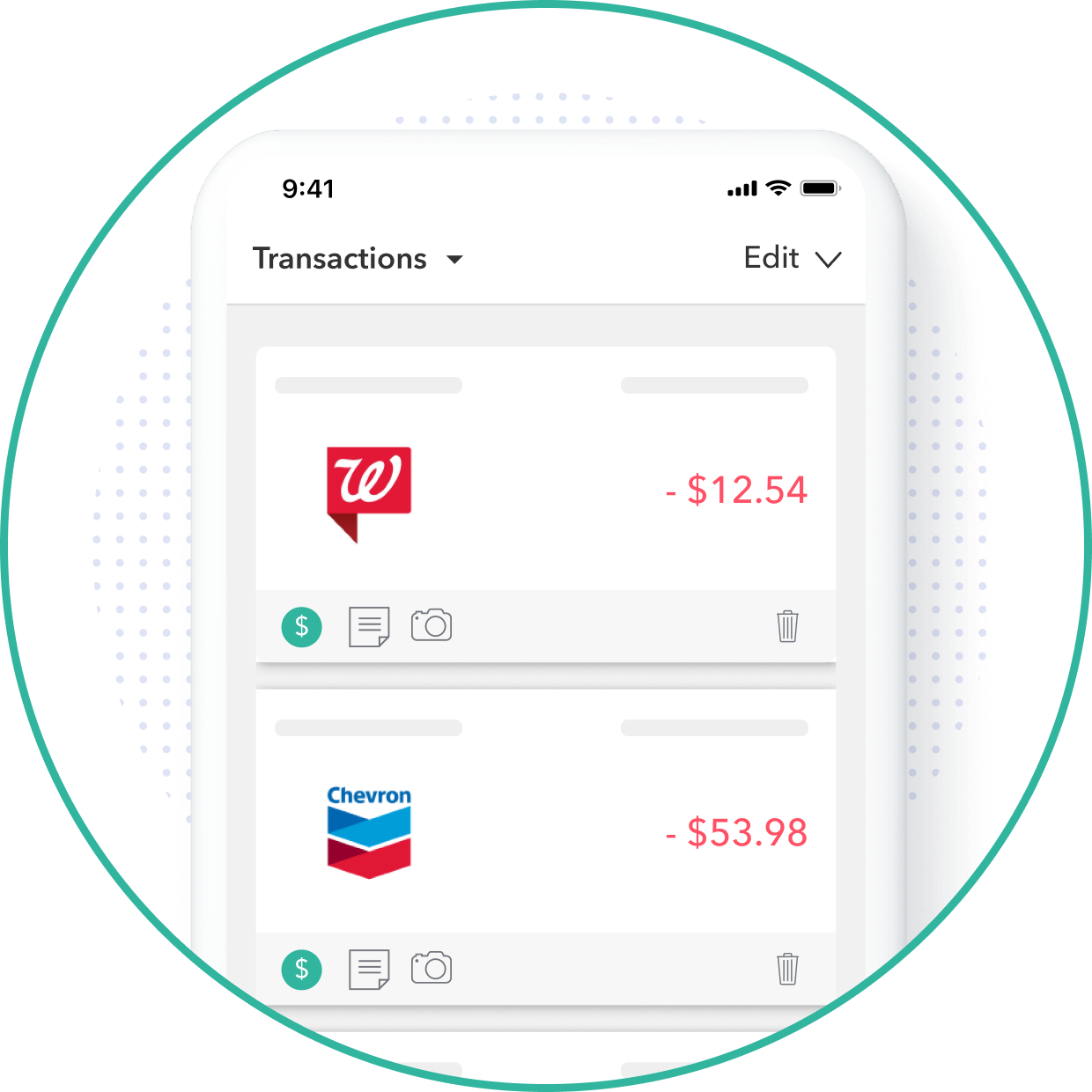

Everlance simplifies tax prep by automatically tracking mileage and expenses, so you only pay what you truly owe.

How Everlance helps with self-employment taxes

Taxes don’t have to be stressful. Everlance was built for freelancers, gig workers, and small business owners who want to simplify tax season and maximize deductions.Everlance was built for self-employed professionals who don’t want to miss a single deduction.

Here’s how Everlance helps:

Our users save thousands every year. and avoid IRS headaches, by letting Everlance do the heavy lifting.

Start tracking taxes & expenses with Everlance today

Download for free“Before Everlance, I was guessing my quarterly taxes. Now I have reports that make it simple, and I save money with deductions I used to miss."

Kevin P

Free tools to simplify your taxes

These free resources help you plan ahead and keep more of your hard-earned money.

Taxes for the self-employed: FAQs

What is the self-employment tax rate for 2025?

It’s 15.3% on net earnings, plus 0.9% extra Medicare tax for higher earners.

Do I have to pay quarterly taxes?

Yes, if you expect to owe more than $1,000 for the year, the IRS requires estimated quarterly payments.

What deductions reduce self-employment taxes?

Mileage, home office, business supplies, software, travel, and insurance premiums all lower your taxable income.

Can I deduct the employer portion of self-employment taxes?

Yes, you can deduct the “employer half” (7.65%) of your self-employment tax when calculating adjusted gross income.

“As a gig worker, I dreaded tax season. Everlance makes it effortless to file with confidence.”

Maria L

Start simplifying your taxes today

Don’t let self-employment taxes catch you off guard. With the right tools and a clear plan, you can pay what you owe, and not a penny more.

Maximize deductions to lower taxable income