Latest business mileage rates, tax tips, and everything you need to know about IRS mileage rates

The IRS mileage rate, sometimes referred to as the federal mileage rate or mileage reimbursement rate, is one of the most important tax deductions for anyone who drives for work, whether you’re a freelancer, rideshare driver, or small business owner. The IRS adjusts the mileage rate annually to reflect the costs of operating a vehicle, such as gas prices and vehicle maintenance.

For 2026, the IRS business mileage rate increased to 72.5 cents per mile, the highest rate in recent years. This change can significantly impact how much you can deduct on your taxes. In this guide, we’ll break down both the 2025 and 2026 mileage rates, explain how they’re calculated, and share tips to maximize your deductions.

The IRS announced December 29th that the standard mileage rate for business miles will increase by 2.5 cents in 2026, while the mileage rate for vehicles used for medical purposes will decrease by half a cent.

The increase for 2026 is largely driven by higher transportation expenses across the board. Fuel prices have remained volatile, vehicle maintenance and repair costs continue to rise, and insurance premiums and financing costs are higher than they were just a few years ago. When combined with ongoing increases in vehicle depreciation, these factors pushed the IRS to raise the standard mileage rate to better match what drivers are actually spending out of pocket. In short, the higher 2026 rate is meant to keep mileage deductions aligned with the true cost of driving for work

Here’s how the new rates impact your expense tracking and deductions:

✅ Business owners & contractors: Higher deduction values for driving can mean more write-offs and lower taxable income, especially if you use your vehicle frequently for work.

✅ Freelancers & gig workers: Apps like Everlance track mileage automatically, so you won’t miss out when rates change, it’ll calculate 72.5 cent per mile rate instead of the old rate.

✅ Employees with allowable deductions: While some employee travel deductions are limited under current tax law, charitable and medical mileage still count for itemized deductions where allowed.

The IRS mileage rate helps create consistency and clarity around how driving expenses are reported. By using the standard rate and following IRS guidelines, taxpayers can confidently deduct business miles without over- or under-claiming expenses, which reduces the risk of errors, audits, or penalties. For employees and employers, the mileage rate also acts as a trusted benchmark for reimbursement, ensuring drivers are fairly compensated for the real cost of using their personal vehicles for work.

The standard mileage rates for the use of a car, van, pickup, or panel truck for the year 2025 were:

The mileage rate for medical use is typically slightly lower than for business use because it takes fewer costs into account. Variable costs, such as gas, are included in the calculation, but not fixed costs that don’t change much based on how many miles you drive, like insurance.

The federal mileage rate for charitable use is set by statute. Currently set at 14 cents per mile, it has not changed in many years.

It's important to understand how to calculate your deductions using the IRS mileage rate for 2025. To do this, simply multiply the number of business miles driven by the standard mileage rate for business use. For medical or moving purposes, multiply the number of qualifying miles by the applicable rate. And for charitable use, the deduction is based on the charitable mileage rate.

For example, let's cover some simple math:

If you drive 10,000 miles for work in 2025, your deduction would be 10,000 miles × 70 cents = $7,000 deduction.

In 2026, that same 10,000 miles will be worth $7,250.

Remember to keep detailed records of your mileage and the purpose of each trip to support your deduction claims in case of an IRS audit. We'll cover more on that below.

The IRS publishes the federal standard mileage rate each calendar year. This sets the per-mile rate for operating vehicles for business, medical, or charitable purposes.

The rate for business represents an estimate of the per-mile costs of using your car, based on nationwide averages in the previous year. To set the business rate, the IRS analyzes these primary data sources:

In particular, gas prices are heavily weighted in the yearly calculation since fuel is a major cost factor directly tied to mileage. The IRS synthesizes these data points to determine a reasonable standard per-mile rate. This rate is also known sometimes as the federal mileage reimbursement rate

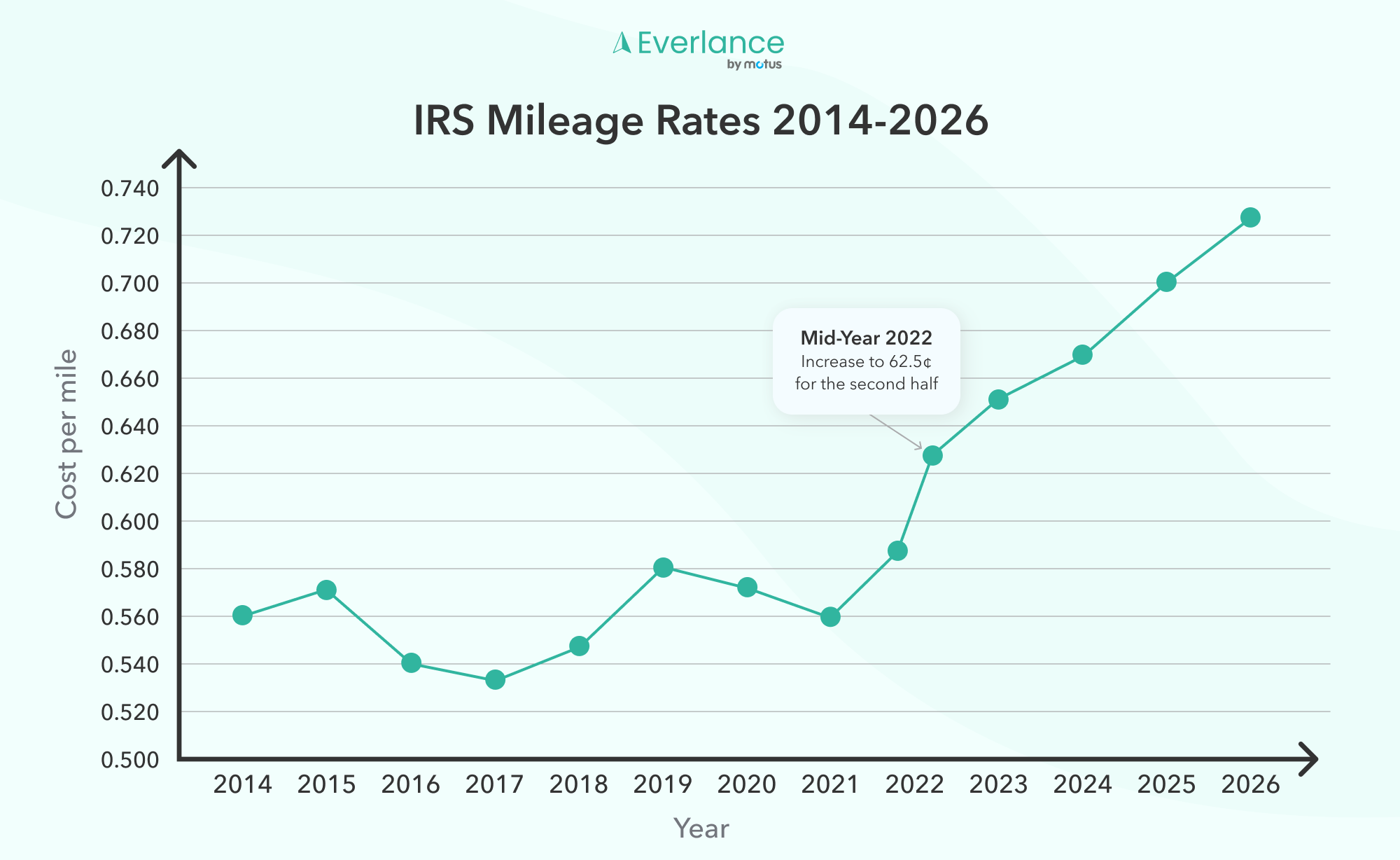

Looking back over the last decade of IRS standard mileage rates provides helpful context on how rates can fluctuate based on inflation, fuel prices, and other cost factors:

2014 - 56 cents per mile

2015 - 57.5 cents per mile

2016 - 54 cents per mile

2017 - 53.5 cents per mile

2018 - 54.5 cents per mile

2019 - 58 cents per mile

2020 - 57.5 cents per mile

2021 - 56 cents per mile

2022* - 58.5 cents/62.5 cents per mile

2023 - 65.5 cents per mile

2024 - 67 cents per mile

2025 - 70 cents per mile

2026 - 72.5 cents per mile

*In 2022, the IRS mileage rate was raised from 58.5 cents to 62.5 cents for the second half of the year, to combat rising costs.

Rates trended lower between 2016 and 2018 due to low national gas prices and modest inflation. However, in recent years, the rate has gone up due to a reverse in those same factors. Higher rates better reflect the true costs that drivers are incurring for business transportation when gas and overall consumer prices are elevated.

Related: IRS Mileage Rate History | Everlance

When it comes to calculating the current mileage rate, there are a few key factors to consider. Whether you're a business owner reimbursing employees for travel or an individual looking to deduct mileage on your taxes, understanding the current rate is essential. Though based on thorough data analysis, IRS mileage rates are inherently estimates. Many variables influence transportation costs annually. Key factors that can impact rate changes include:

The IRS considers these variables when setting each year's mileage deduction rate. For 2024, inflation and gas prices had the biggest influence, barring wider economic impacts. In 2025, vehicle depreciation lead the charge in setting a higher rate.

Maintaining detailed records of mileage, including dates, destinations, business purpose, and total miles driven, is crucial for accurate deductions. Utilizing modern technology, such as mileage tracking apps, can streamline the record-keeping process and ensure reliable documentation.

Moreover, embracing technology can further enhance your record-keeping efforts. Mileage tracking apps not only simplify the task of logging your trips but also provide a convenient way to store and categorize your mileage data. This digital approach not only saves time but also minimizes the risk of errors or missing information, ultimately maximizing your potential deductions.

If you do prefer to do it by hand, we recommend keeping a mileage log spreadsheet to keep all of your trips and purposes safe and organized. This does require more work than using a mileage tracking app, since you need to write out by hand while you drive, and then transcribe your trips to the spreadsheet.

Source: IRS Notice 2025-05 (PDF)